The Ultimate Truth About Housing Affordability

“…measures whether or not a typical family earns enough income to qualify for a mortgage loan on a typical home at the national and regional levels based on the most recent price and income data.”

Their methodology states:

“To interpret the indices, a value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home. An index above 100 signifies that family earning the median income has more than enough income to qualify for a mortgage loan on a median-priced home, assuming a 20 percent down payment.”

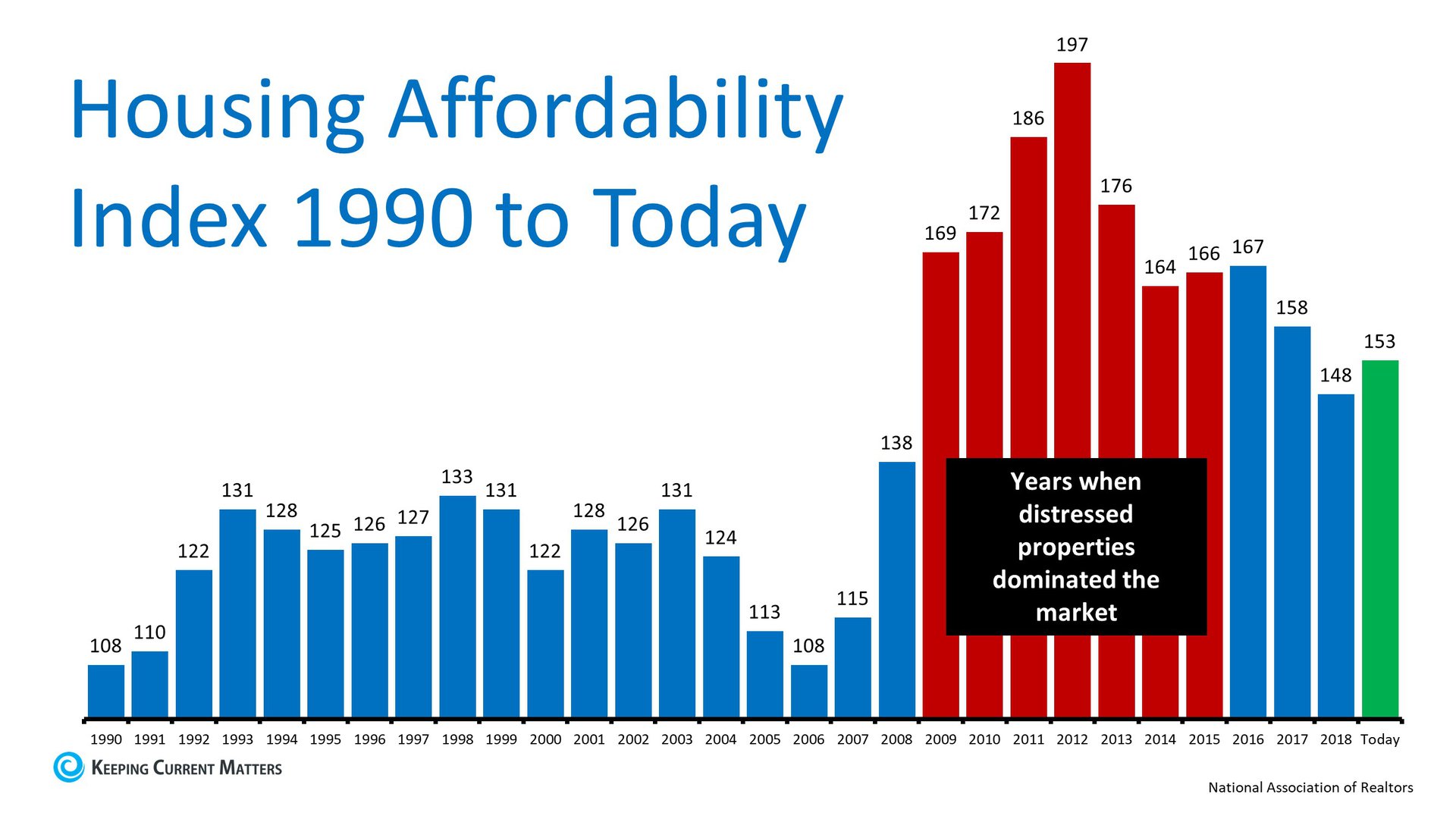

So, the higher the index, the more affordable it is to purchase a home. Here is a graph of the index going back to 1990:

It is true that the index is lower today than any year from 2009 to 2017. However, we must realize the main reason homes were more affordable. That period of time immediately followed a housing crash and there were large numbers of distressed properties (foreclosures and short sales). Those properties were sold at large discounts.

Today, the index is higher than any year from 1990 to 2008. Based on historic home affordability data, that means homes are more affordable right now than any other time besides the time following the housing crisis.

With mortgage rates remaining low and wages finally increasing, we can see that it is MORE AFFORDABLE to purchase a home today than it was last year!

Bottom Line

With wages increasing, price appreciation moderating, and mortgage rates remaining near all-time lows, purchasing a home is a great move based on historic affordability numbers.

Courtesy NAR & Keeping Current Matters